What Is The New EV Tax Credit?

The Inflation Reduction Act Could Have a Big Impact On Your Next Car Purchase.

Shutterstock

Shutterstock

With President Joe Biden signing the Inflation Reduction Act into law, the Federal tax credit for electric vehicles changed and will change even more January 1, 2023. Here are some things to consider, and what’s new with the electric vehicle tax credit.

Used Electric Vehicle Tax Credit

For the first time, used EVs will be eligible for a federal tax credit starting January 1, 2023. There are two parts that determine eligibility: the vehicle itself, and the buyer.

Vehicle Eligibility

The credit could be up to 30% of the used car price for a maximum credit of $4,000. Only vehicles purchased for under 25,000 are eligible for the used EV credit. The used EV must be purchased from a dealer and be at least two years old. Notably, the purchaser cannot claim the credit for buying their own leased vehicle after maturity. In addition, the credit can only be claimed once in the vehicle’s life.

Buyer Eligibility

The used EV credit can be claimed once every three years per person.Then, there’s an income limit for the purchaser to be eligible as well: $150,000 for joint returns, $112,500 for head of household, and $75,000 for others for the year of purchase.

Some states are already providing rebates/incentives to used-EV buyers, however this federal tax credit and those programs are separate and differ in eligibility. Check your state’s website or plugstar.com for all the available incentives.

Eligibility Factors for New Electric Vehicles

This is where things get more complicated, as new requirements for the EV tax credit are more complex than the previous rules. There are three factors that the vehicle must meet to be eligible for the tax credit: the vehicle must be assembled in North America, a percentage of the battery components must be made in the U.S. or certain free-trade partner countries, and a percentage of the battery’s critical minerals must be mined in North America or free-trade partner countries. After determining the eligibility of the vehicle, then a buyer must qualify as well, which is similar to the buyer eligibility for used EV tax credit requirements.

Some Things We Know For Sure

Some of the criteria established by the bill were made clear, but other details will be determined by the IRS, but have not yet been released. The particulars of “how” to determine the source of battery minerals and battery components lands in that category. Those details will be determined by the IRS prior to December 31, 2022.

North American Assembly

The North American Assembly requirement became effective immediately upon the Inflation Reduction Act's passage on August 16, 2022. You can check a vehicle’s assembly location by using the

Battery Minerals

The $7,500 total possible tax credit is separated into two parts. The first $3,750 is for vehicles with at least 40% of their battery's critical minerals mined in the United States or in countries with a free-trade agreement with the United States (which are listed in a moment) or recycled in North America. The major suppliers of battery minerals are China, Australia, Brazil, Canada, South Africa, Chile, Indonesia, the Republic of Congo, the Philippines, Finland, and Japan. The percentage requirement will increase 10% annually to a cap of 80% by December 31, 2026.

Battery Components

The second $3,750 depends on whether at least 50% of the battery components of the vehicle are manufactured or assembled in North America. Currently, most major battery components are manufactured in South Korea (LG Energy Solution, SK on, Samsung SDI), Japan (AESC, Panasonic, PPES), China (CATL, AESC, Panasonic), Germany, and Sweden. A number of South Korean battery components suppliers are rapidly expanding production in the U.S. and Canada, and with the new North American manufacturing or assembly rule, they're well positioned for future demand.

The battery component percentages will rise gradually, eventually reaching 100% by December 31, 2028.

Free-Trade Partners

The U.S. currently has free-trade agreements in force with Canada, Mexico, South Korea, Israel, Australia, Chile, Jordan, Israel, Singapore, Bahrain, Morocco, Oman, Peru, Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, the Dominican Republic, Colombia, and Panama.

This creates a particular issue with manufacturers like Tesla, which relies on components and materials from China and Japan. Any vehicle with battery minerals or components from a foreign entity of concern, such as China or Russia, is excluded from the tax credit beginning Jan 1, 2025.

Price Matters

Then there’s the governing rule of MSRP (Manufacturer’s Suggested Retail Price) classification and limit. The new scheme limits the MSRP of the electric vehicle to $80,000 for SUVs and trucks and $55,000 for all other vehicles. This is not the base (starting) MSRP of the model; it’s the final MSRP, including all the options and destination charges, as shown on the window sticker.

Your Income Matters, Too

Similar to tax credits for used EVs, the purchaser’s income limits the eligibility for the tax credit too. Modified gross income limits for the year of purchase are $300,000 for joint returns, $225,000 for the head of household, and $150,000 for all others.

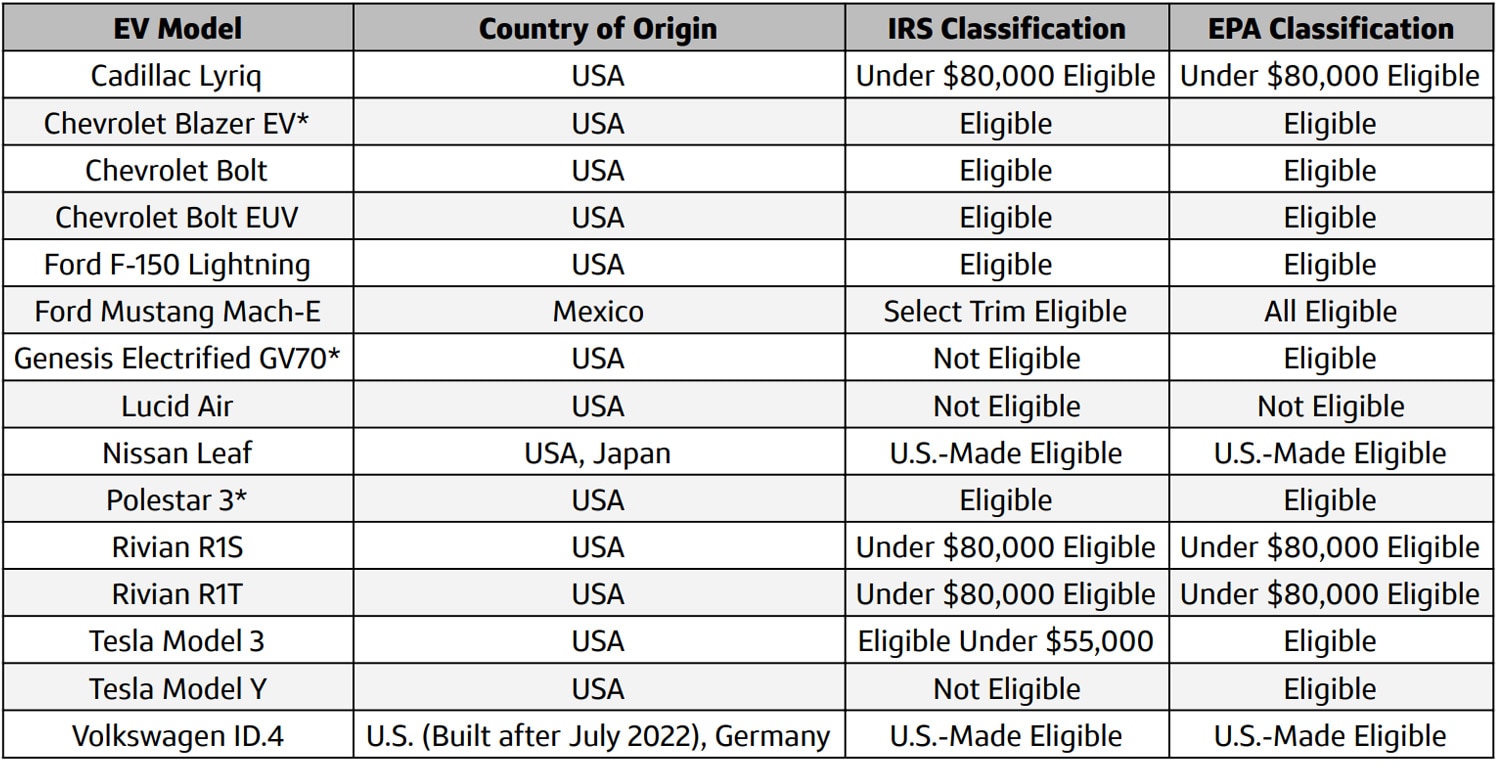

What Isn’t Final? Vehicle Classification

By introducing classification as a point of eligibility, the new law does leave some gray area about what may, or may not, be eligible depending on how each vehicle is classified. It all comes down to whether the IRS uses vehicle weight or interior volume to determine what makes a particular EV a “car” or an SUV. This all matters quite a bit because EVs are typically quite a bit heavier than the average vehicle with an identical external footprint, and to be eligible for the credit SUVs, trucks, and vans have a price cap of $80,000 and all other vehicles, $55,000. That being said, if eligibility is based on the gross vehicle weight rating (GVWR), then the list will be naturally limited by both GVWR and MSRP.

EPA Vehicle Classification

The bill suggests using similar class criteria of EPA classification, which uses a vehicle’s interior volume as the main differentiating factor between different cars. What makes a compact or a large sedan? By the EPA rule, it’s passenger plus cargo volume. It’s a little different for trucks and SUVs, however, which are classified by the gross vehicle weight rating, also known as GVWR.

IRS Vehicle Classification

But since we’re talking about a tax credit, it’s possible eligibility may follow IRS guidelines, which are determined by vehicle weight alone.

According to the IRS (for the purpose of taxes) an SUV or truck is a vehicle with over 6,000 lbs of GVWR, which is the loaded weight of the vehicle. Curb weight generally refers to the vehicle with no load. The GVWR includes the vehicle's weight, government-declared weights for people who can ride in the crossover vehicle, and a government-declared weight based on the cubic feet of the cargo area. Manufacturers post the GVWR on a metal or paper plate on the driver-side door or door frame, so one easy way to identify the GVWR is to open the driver’s door and take a look.

The final determination on how EVs will be classified, alongside how battery minerals and component calculations will be made, will be announced by the IRS before Dec 31, 2022.

* Figures for these vehicles have not been confirmed yet, but manufacturer estimates have been used when estimating eligibility.

The upcoming Genesis Electrified GV70 will fall just below 6,000 lbs GVWR based on the Korean market vehicle, though it’s not certified for US sale yet.

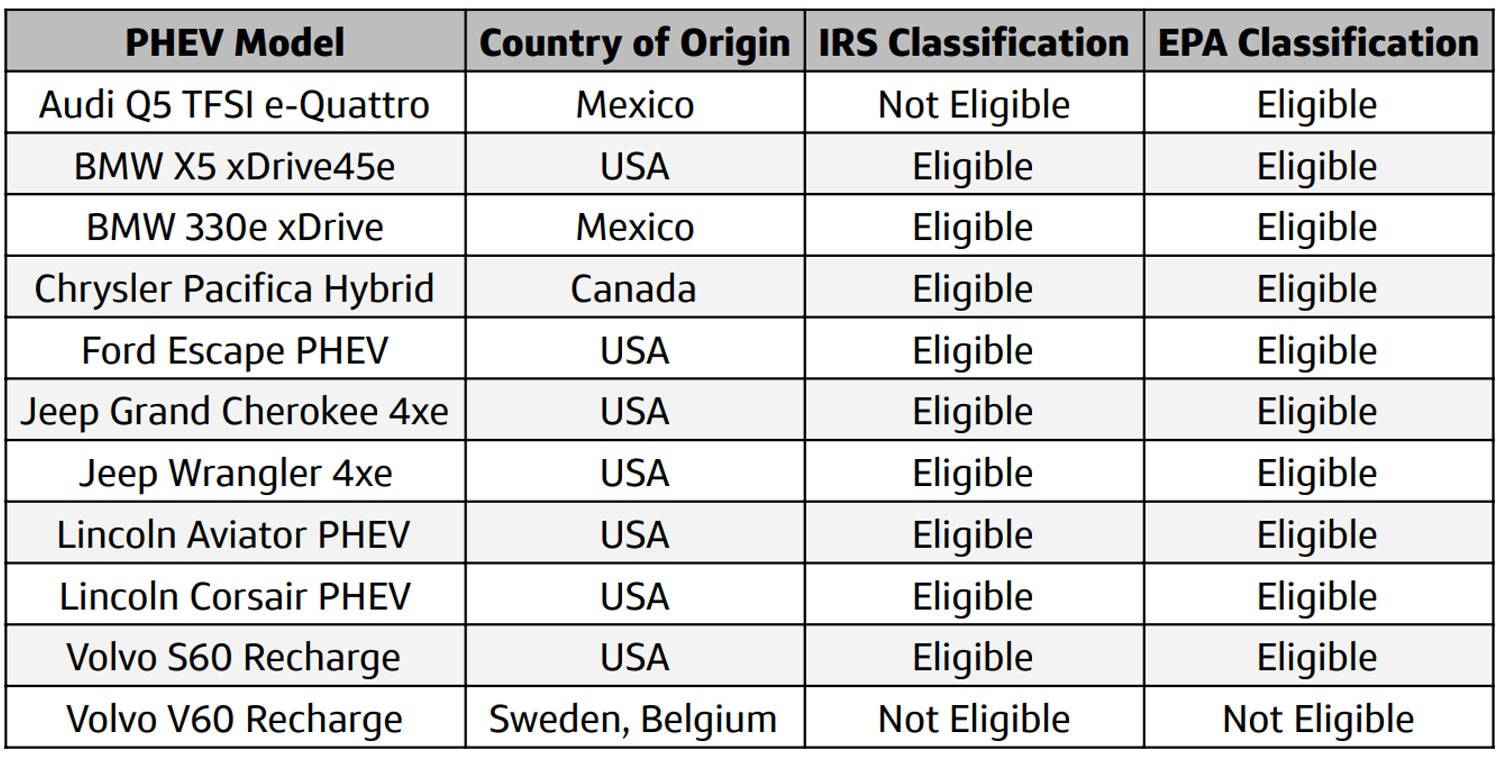

Eligible Plug In Hybrids

Plug-in hybrid models will also be eligible under the new tax credit, and most of them will not be disqualified by classification, though like with the EVs, battery mineral and component elements may disqualify more.

Some Final Considerations

Looking a little further out, by 2024 dealers might be able to apply for the tax credit at the point of the sale, similar to how some manufacturers are applying the manufacturer’s rebate as part of a down payment/cap cost reduction. Under the old plan, some financial institutions reflected part of the tax credit as a rebate to leasing customers since the purchaser of the car is the bank/finance company, not the customer who leases the vehicle. This new method of effectively reflecting the tax credit up front as a discount or rebate for lessees could ease the higher cost of EVs. However, under the new scheme, if the buyer’s tax liability is less than the tax credit or their income is higher than the limit on the year purchasing the EV, the purchaser would have to pay back the tax credit when filing taxes the following spring if the tax credit was at the time of purchase.

It’s prudent to consult a tax professional regarding your tax situation, especially when considering the complexity of the new EV tax credit.

The IRS has until Dec. 31, 2022, to develop guidance on the battery requirements and vehicle classification, and publish how the parts-origin calculations and phased requirements of the tax credit would be implemented.

States, local municipalities, and companies often offer rebate/incentive programs to purchase new EVs and install Level 2 home chargers. Other vehicles on the market might be eligible for those regardless of the status of this tax credit.

Written by humans.

Edited by humans.

Mel Yu

Mel YuMel is from the Gangnam district of Seoul, South Korea, and he first came to the U.S. to study mechanical engineering. Since 2000, he has worked in various auto-industry fields, ranging from new-car dealers to consulting major automakers. In his free time, he flies a Piper aircraft and hunts for automotive unicorns.

Related articles

View more related articles